Get the free pf nomination form download

Show details

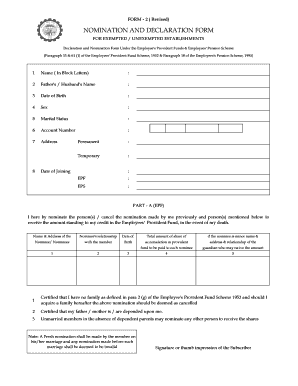

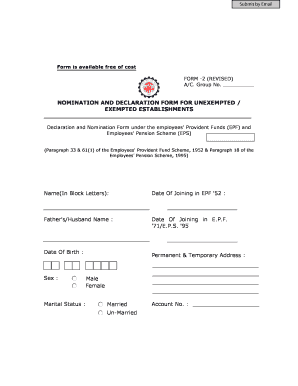

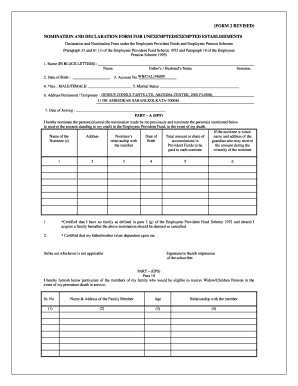

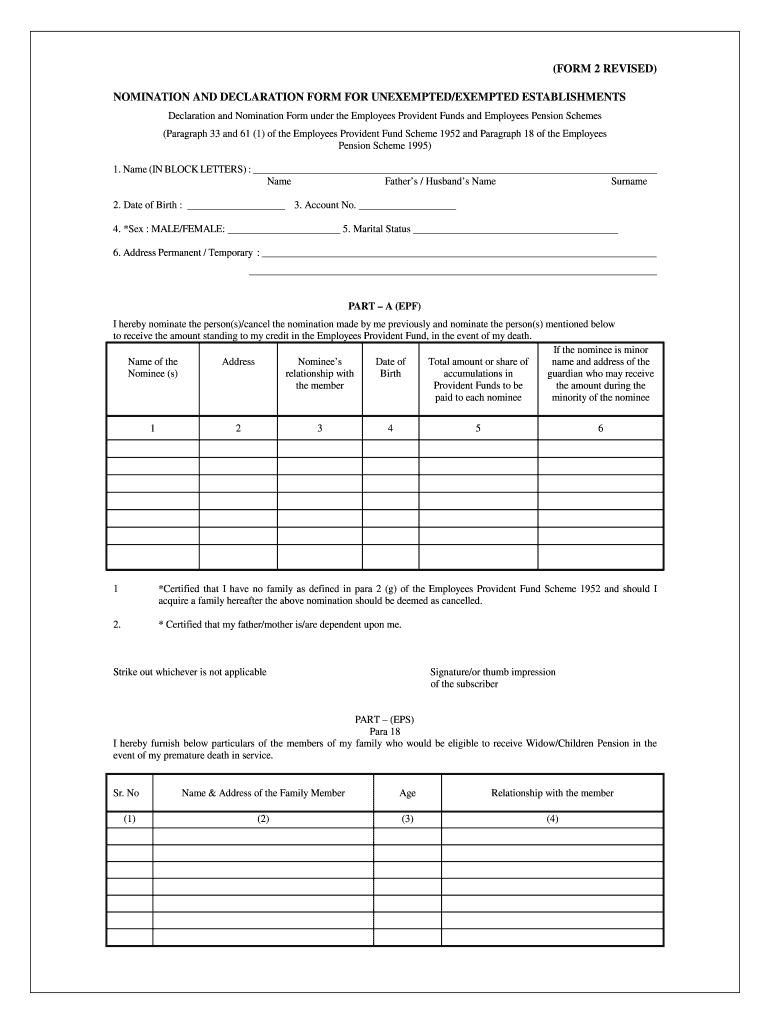

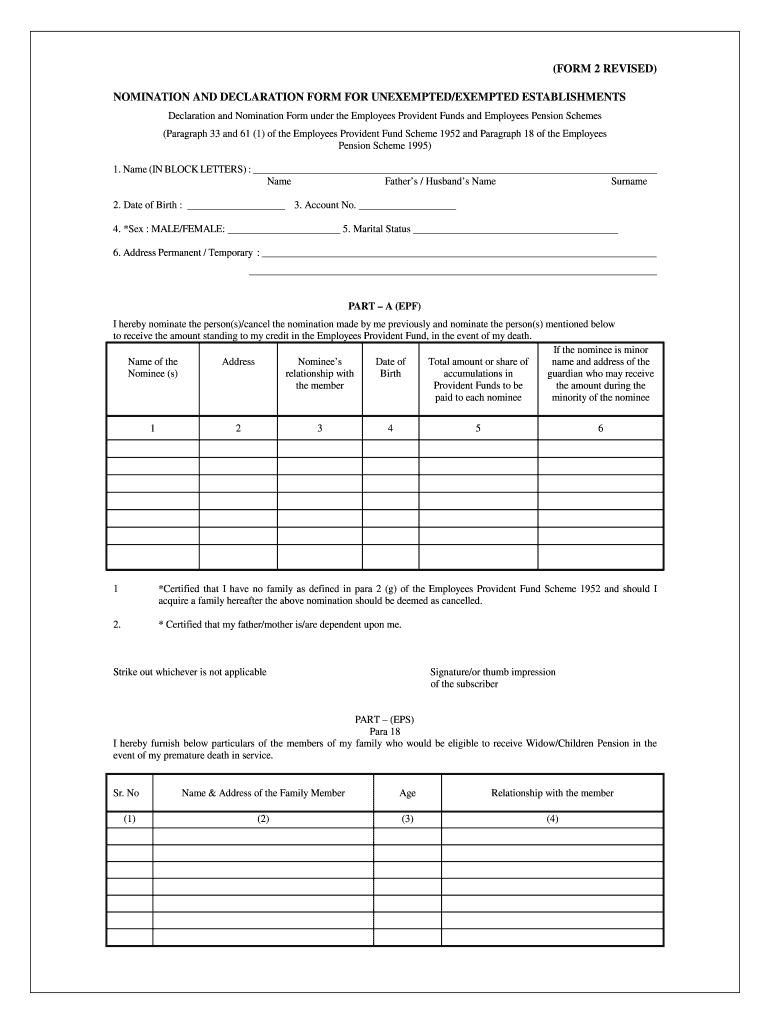

(FORM 2 REVISED) NOMINATION AND DECLARATION FORM FOR EXEMPTED/EXEMPTED ESTABLISHMENTS Declaration and Nomination Form under the Employees Provident Funds and Employees Pension Schemes (Paragraph 33

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your pf nomination form download form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pf nomination form download form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pf nomination form download online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 2 nomination and declaration form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

How to fill out pf nomination form download

How to fill out pf form 2:

01

Begin by gathering all the necessary information and documents required to fill out pf form 2. This may include details such as personal information, employment history, bank account details, and more.

02

Next, carefully read through the instructions and guidelines provided with the form. This will ensure that you understand the requirements and can accurately complete the form.

03

Start filling out the form by entering your personal information such as your full name, address, contact details, and social security number, as required.

04

Proceed to provide your employment details such as the name of your employer, the duration of your employment, your job position, and your salary or wages.

05

If necessary, provide information regarding any previous employment or income earned during a specific period.

06

Fill in details of any other income, if applicable, such as rental income or income from investments.

07

Enter your bank account details accurately for the transfer of your provident fund funds.

08

Review the completed form thoroughly to ensure that all the information provided is accurate and legible.

09

Once you have reviewed the form, affix your signature, and date the form in the designated spaces.

10

Submit the filled-out pf form 2 to the appropriate authority or department as per the instructions provided.

Who needs pf form 2?

01

Employees who are eligible for provident fund benefits under their employer's scheme typically require pf form 2.

02

Individuals who are applying for the withdrawal of their provident fund funds or seeking a transfer of their provident fund account to a new employer often need to fill out pf form 2.

03

Employees who are leaving their current job and want to withdraw their accumulated provident fund balance or transfer it to a different account or scheme may be required to fill out pf form 2.

04

Individuals who have changed their jobs and want to transfer their provident fund account from their previous employer to their new employer may need to submit pf form 2.

05

Employees who wish to avail of loans against their provident fund balance may be required to fill out pf form 2 as part of the loan application process.

06

Individuals who want to update their personal or employment details related to their provident fund account may need to fill out pf form 2.

07

Employees who have retired or reached the age of retirement and wish to withdraw their accumulated provident fund balance would typically need to submit pf form 2.

Fill form 2 pf nomination pdf : Try Risk Free

What is pf nomination declaration form?

Every employee is required to nominate the member(s) to the EPF account under the Employees' Provident Fund Scheme, 1952. ... The employee is required to fill up some basic details which include information like name, marital status, address, and date of birth, and submit it to declare and nominate the same.

People Also Ask about pf nomination form download

What are forms 2?

How to fill PF nomination and declaration form 2?

What is the form 2 of PF?

What is form 2 declaration?

What is Form 2 declaration?

How to fill provident fund form 2?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is pf form 2?

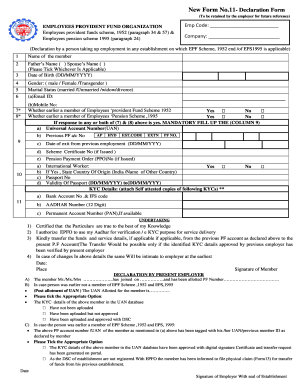

PF Form 2 is an Employee’s Declaration Form issued by the Employees’ Provident Fund Organisation (EPFO) of India. The form is used to declare the details of a new employee joining a company, which includes the employee’s name, date of birth, address, PAN card number, bank account details, etc. It is mandatory for all employers to fill in this form when hiring a new employee.

What is the purpose of pf form 2?

PF Form 2 is used for the purpose of updating the details of a provident fund member. This form is used to provide the details of the member, such as name, date of birth, address, and other information. It is also used to update the account details like nominee details, bank account details, and other information.

What information must be reported on pf form 2?

PF Form 2 is used to report the earnings and contributions of workers who are members of the Employees' Provident Fund (EPF). The form requires the employer to report the total salary and wages for the month, total amount of EPF contribution, total number of days the employee worked in the month, total number of hours worked, and the employees' EPF account number and name.

When is the deadline to file pf form 2 in 2023?

The deadline to file PF Form 2 for the year 2023 has not yet been announced. Generally, the due date for filing PF Form 2 is 30th April of the following year.

Who is required to file pf form 2?

PF Form 2 is typically filed by an employee who wishes to withdraw their accumulated provident fund balance. It is also filed by a nominee or legal heir in the event of the death of the employee.

How to fill out pf form 2?

To fill out PF Form 2, follow these steps:

1. Provide your personal details: Write your name, date of birth, and gender.

2. PF Account information: Fill in your PF Account number and establishment code.

3. Employer details: Enter your employer's name and address.

4. Employment duration: Mention the start and end dates of your employment with the given employer.

5. Reason for leaving: Specify the reason for leaving your previous job, such as resignation, termination, retirement, or any other applicable reason.

6. Details of nominee: Write the details of the nominee who will receive the provident fund benefits in case of your untimely demise. Include their name, relationship to you, and their address.

7. Signature and date: Sign the form and write the current date.

8. Submit the form: Give the filled-out PF Form 2 to your employer or the appropriate authority, as per the instructions provided by your employer or the organization managing your provident fund account.

Make sure to double-check all the information you provide to avoid any errors or discrepancies. It may be helpful to refer to any guidelines or instructions provided along with the form.

What is the penalty for the late filing of pf form 2?

The penalty for late filing of PF Form 2 (Annual Return of Employees Qualifying for Membership) may vary depending on the specific rules and regulations in your country or region. In India, for example, if an employer fails to file Form 2 within the due date, a penalty of 50 rupees per day of default may be imposed. However, it is recommended to consult the relevant government authorities or labor laws in your jurisdiction for accurate and up-to-date information regarding penalties for late filing of PF Form 2.

How can I send pf nomination form download for eSignature?

Once your form 2 nomination and declaration form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for signing my form 2 pf in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your pf form no 2 download pdf right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out the form 2 revised download form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign pf form 2 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your pf nomination form download online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 2 Pf is not the form you're looking for?Search for another form here.

Keywords relevant to form 2 epf pdf

Related to pf form no 2

If you believe that this page should be taken down, please follow our DMCA take down process

here

.